Types of information ?

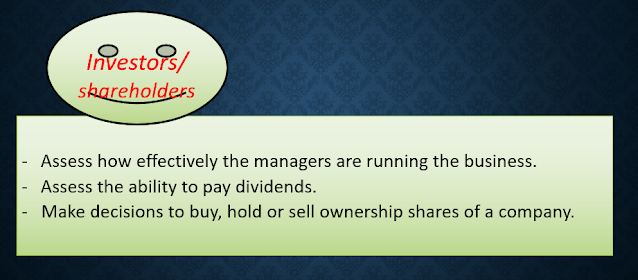

When you read the accounting information, What type of information do you need? User Types of needs to accounting information Investors/shareholders - Assess how effectively the managers are running the business. - Assess the ability to pay dividends. - Make decisions to buy, hold or sell ownership shares of a company. Lenders - Evaluate the risks of granting credit or lending money. - Assess the ability to pay interest and repay the amount borrowed. Suppliers and other trade creditors. - Determine whether amount owned to them will be paid when due trade creditors are likely to be interested in an entity over a short period than lenders unless they are dependent upon the continuation of entity as a major customer. Customers - Know if the company will continue to honor product warranties and support its products